NEXTDC, Australia’s leading data centre solutions provider, today announced strong financial results for the FY20 fiscal year, ending 30 June 2020. Accelerated deployments of high density capacity to support digital transformation, and interconnection solutions creating strong tailwinds of opportunity.

NEXTDC Chief Executive Officer and Managing Director, Craig Scroggie, commented “Today’s results are a testament to the Company’s pursuit of excellence to provide the industry’s highest standard of data centre services. Whilst everyone is adjusting to the new normal presented by the COVID-19 global pandemic, it is pleasing that NEXTDC has been able to continue delivering on market expectations, with our FY20 result coming in at the top-end of earnings guidance provided at the start of the financial year.”

FY20 saw NEXTDC celebrate a number of major milestones in the business. In May 2020, NEXTDC reached its 10th anniversary since company foundation, bringing closure to a decade where the business has dedicated itself to delivering on the vision of building the nation’s leading data centre infrastructure platform for the digital age.

Following the ten year milestone, NEXTDC’s sustained growth saw the Company enter the ASX 100 index.

“It’s been an exciting journey watching the Company grow from a start-up, to becoming one of Australia’s 100 largest publicly listed companies by market capitalisation in just ten years. Both of these milestones have allowed us to reflect on, and celebrate our achievements in setting new industry standards for reliability, efficiency, sustainability, connectivity and security” said Craig.

As the business enters FY21, it represents the start of the next decade, which promises further accelerated growth and innovation.

“The past ten years has seen us build a scalable and sustainable business, which we are incredibly proud of. Our business has seen us earn us the trust and partnership of our valued customers and partners, who have come to rely on our infrastructure as a critical enabler of their most strategic objectives. But it’s the opportunities that the next ten years will bring that excite us the most” added Craig.

FY20 financial highlights

- Total revenue grew $26.0 million (14%) to $205.2 million (Guidance: $200 million to $206 million)

- Underlying EBITDA up $19.5 million (23%) to $104.6 million (Guidance: $100 million to $105 million)

- Operating cash flow up $14.6 million (37%) to $53.9 million

- Capital expenditure up $40 million (11%) to $418 million (Guidance: $340 million to $380 million)

- Build progress accelerated towards year end, and the land acquisition for M3 Melbourne was settled ($22 million)

- Liquidity (cash and undrawn debt facilities) of $1,193 million at 30 June 2020.

Business performance

- Contracted utilisation grew 17.4MW (33%) to 70.0MW, with new sales of 17.8MW before adjusting for a one-off clawback of wholesale capacity of 0.4MW

- New customer acquisition increased by 180 (15%) to 1,364

- Interconnections rose to 2,079 (19%) to 13,051.

Development activity

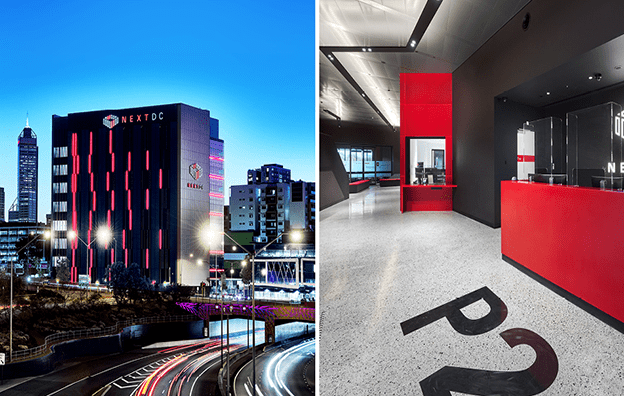

- P2 Perth opened to customers just after FY20 year end with installed capacity of 2MW

- S2 Sydney building completed with four new data halls opened, taking total installed capacity to 22MW

- S3 Sydney site earthworks commenced in 2H FY20. Practical completion of Stage 1 scheduled for 2H FY22

- M2 Melbourne total target capacity upgraded by 20MW to 60MW

- M2 Melbourne building expansion works well progressed, with 15MW of new capacity currently being deployed

- M3 Melbourne site was acquired in 2H FY20 with works relating to design and planning approvals underway.

Business outlook

FY21 guidance

NEXTDC provides the following guidance for FY21:

- Data centre services revenue in the range of $242 million to $250 million (FY20: $200.8 million)

- Underlying EBITDA in the range of $125 million to $130 million (FY20: $104.6 million)

- Capital expenditure in the range of $380 million to $400 million (FY20: $418 million)

For full details read the ASX announcement and view the FY20 full-year results pack.