NEXTDC Limited (ASX: NXT) (“NEXTDC” or “the Company”) today announced its financial results for the half-year ended 31 December 2021 (“1H22”).

1H22 financial highlights

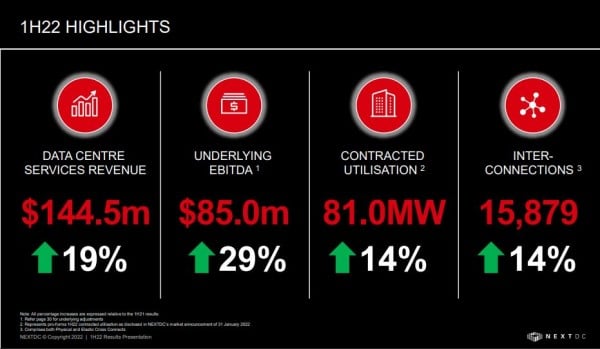

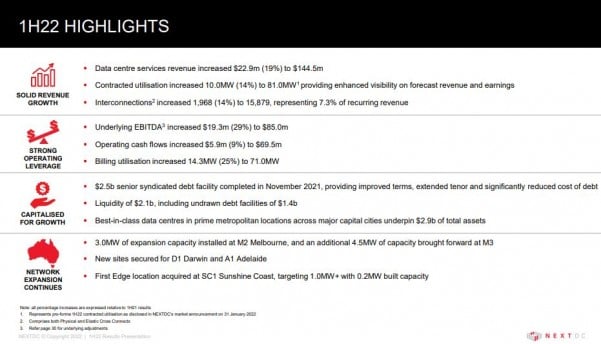

- Data centre services revenue increased $22.9 million (19%) to $144.5 million (1H21: $121.6 million)

- Underlying EBITDA1,2 increased $19.3 million (29%) to $85.0 million (1H21: $65.7 million)

- Operating cash flow increased $5.9 million3 (9%) to $69.5 million

- Liquidity (cash and undrawn debt facilities) of $2.1 billion at 31 December 2021

NEXTDC Chief Executive Officer and Managing Director, Craig Scroggie, commented on the 1H22 results:

“We are pleased to deliver another record result in 1H22, with strong metrics across the business that now positions the Company to provide upgraded earnings guidance for FY22. NEXTDC’s leading national digital infrastructure platform continues to demonstrate strong growth and critical resilience as it continues to mature.”

Business performance

For the 12 months to 31 December 2021:

*Contracted utilisation increased 10.0MW4 (14%) to 81.0MW5

- Customer numbers grew by 144 (10%) to 1,569 (31 December 2020: 1,4256)

- Interconnections rose 1,968 (14%) to 15,879, representing 7.3% of recurring revenue

Development activity

- S3 Sydney building construction tracking on time, on budget, with practical completion of Stage 1 (12MW of initial capacity) on target for 2H22

- M2 Melbourne fitout continued with 3MW of capacity added to support customer requirements. Building expansion works continue on time, on budget, with 3MW of additional capacity being added to support customer growth

- M3 Melbourne building construction on time, on budget, with practical completion of Stage 1 (13.5MW of initial capacity) on target for 1H23. An additional 4.5MW of capacity is being added to support early customer contracted requirements

- In December 2021, NEXTDC acquired its first edge data centre Sunshine Coast (SC1), an operational site with 0.2MW of built capacity, targeting 1MW+ at completion

- New sites secured for D1 Darwin and A1 Adelaide

FY22 upgraded guidance

Based on current billing, contracted utilisation levels and expected new customer contracts, NEXTDC provides the following upgraded guidance for FY22:

- Data centre services revenue in the range of $290 million to $295 million (upgraded from $285 million to $295 million)

- Underlying EBITDA8 in the range of $163 million to $167 million (upgraded from $160 million to $165 million)

- Capital expenditure in the range of $530 million to $580 million (upgraded from $480 million to $540 million)

Commenting on the upgrade to guidance, Mr Scroggie said:

“As a result of the strong 1H22 performance, the Company is able to upgrade its FY22 Guidance as well as accelerate project investments in 2H22. With liquidity of over $2 billion, combined with record operating cashflow, NEXTDC is in an outstanding position to take advantage of current and future customer opportunities and to press its advantage into new regions and edge locations.”

For full details read the ASX announcement and the 1H22 results presentation.